This link to Robert Reich on Facebook, WhatsApp and the economy is instructive when we look for solutions to the unemployment created under neo-liberal economic policies and austerity based decisions.

22 Feb 2014

14 Feb 2014

Forgotten Economic Lessons that have impacted on New Zealand. (Social Journal Europe)

Simply changing America to New Zealand and the lessons Robert Reich says America forgot demonstrates how the neo-liberal economics with its promise of a golden deluge from giving tax cuts and subsidies to the uber wealthy to benefit the workers and productively employed has seriously destroyed job creation, employment opportunities, wealth creation and a stable and dynamic economy in New Zealand.

Why The Three Biggest Economic Lessons Were Forgotten

Robert Reich

Before I answer that question, let me remind you what those lessons were:

First, America’s real job creators are consumers, whose rising wages generate jobs and growth. If average people don’t have decent wages there can be no real recovery and no sustained growth.

In those years, business boomed because American workers were getting raises, and had enough purchasing power to buy what expanding businesses had to offer. Strong labor unions ensured American workers got a fair share of the economy’s gains. It was a virtuous cycle.

Second, the rich do better with a smaller share of a rapidly-growing economy than they do with a large share of an economy that’s barely growing at all.

Between 1946 and 1974, the economy grew faster than it’s grown since, on average, because the nation was creating the largest middle class in history. The overall size of the economy doubled, as did the earnings of almost everyone. CEOs rarely took home more than forty times the average worker’s wage, yet were riding high.

Third, higher taxes on the wealthy to finance public investments — better roads, bridges, public transportation, basic research, world-class K-12 education, and affordable higher education – improve the future productivity of America. All of us gain from these investments, including the wealthy.

In those years, the top marginal tax rate on America’s highest earners never fell below 70 percent. Under Republican President Dwight Eisenhower the tax rate was 91 percent. Combined with tax revenues from a growing middle class, these were enough to build the Interstate Highway system, dramatically expand public higher education, and make American public education the envy of the world.

We learned, in other words, that broadly-shared prosperity isn’t just compatible with a healthy economy that benefits everyone — it’s essential to it.

We Forgot Our Economic Lessons

But then we forgot these lessons. For the last three decades the American economy has continued to grow but most peoples’ earnings have gone nowhere. Since the start of the recovery in 2009, 95 percent of the gains have gone to the top 1 percent.What happened?

For starters, too many of us bought the snake oil of “supply-side” economics, which said big corporations and the wealthy are the job creators – and if we cut their taxes the benefits will trickle down to everyone else. Of course, nothing trickled down.

Meanwhile, big corporations were allowed to bust labor unions, whose membership dropped from over a third of all private-sector workers in the 1950s to under 7 percent today.

Our roads, bridges, and public-transit systems were allowed to crumble under the weight of deferred maintenance. Our public schools deteriorated. And public higher education became so starved for funds that tuition rose to make up for shortfalls, making college unaffordable to many working families.

And Wall Street was deregulated — creating a casino capitalism that caused a near meltdown of the economy six years ago and continues to burden millions of homeowners. CEOs began taking home 300 times the earnings of the average worker.

Part of the reason for this extraordinary U-turn had to do with politics. As income and wealth concentrated at the top, so did political power. The captains of industry and of Wall Street knew what was happening, and some played leading roles in this transformation.

But why didn’t they remember the lessons learned in the thirty years after World War II – that widely-shared prosperity is good for everyone, including them?

Perhaps because they didn’t care to remember. They discovered that wealth is also relative: How rich they feel depends not just on how much money they have, but also how they live in comparison to most other people.

As the gap between America’s wealthy and the middle has widened, those at the top have felt even richer by comparison. Although a rising tide would lift all boats, many of America’s richest prefer a lower tide and bigger yachts.

This blogpost was first published on Robert Reich’s Blog

10 Feb 2014

More from Social-Journal Europe: Mainstream Economics fail to see the consequences of growing income and Wealth inequality

How Mainstream Economics Failed To Grasp The Importance Of Inequality

Jon Wisman

(photo: American University)

(photo: American University)

The restricted focus of mainstream

economists has meant that not much attention has been given to the

economic and social consequences of changing income and wealth

inequality. Jon D. Wisman critiques

their restricted scope and contends that it impeded them from seeing

how 30 years of wage stagnation and soaring inequality were generating

excessive speculation, indebtedness, and political changes that set the

underlying conditions for the financial crisis of 2008.

The financial crisis of 2008 launched

the second most severe depression in capitalism’s history. Although its

causes have been endlessly discussed, attention has remained fixed on

surface reality or proximate causes such deregulation, inadequate

oversight, low interest rates, “irrational exuberance,” and moral

hazard. Ignored has been what was going on beneath the surface: 30 years

of wage stagnation and exploding inequality—powerful forces that were

churning up complex dynamics to make a financial crisis all but

inevitable. During the 1920s, the same forces had set the stage for the

crash of 1929, but the economics profession missed that one too.

The magnitude of exploding inequality since the mid-1970s is captured by the following: Between 1979 and 2007, inflation-adjusted income,

including capital gains, increased $4.8 trillion — about $16,000 per

person. Of this, 36 percent was captured by the richest 1 percent of

income earners, representing a 232 percent increase in their per capita

income. The richest 10 percent captured 64 percent, almost twice the

amount collected by the 90 percent below. Between 1983 and 2007, total

inflation-adjusted wealth in the U.S. increased by $27 trillion.

If divided equally, every man woman and child would be almost $90,000

richer. But of course it wasn’t divided equally. Almost half of the $27

trillion (49 percent) was claimed by the richest one percent — $11.7

million more for each of their households. The top 10 percent grabbed almost $29 trillion,

or 106 percent, more than the total because the bottom 90 percent

suffered an average decline of just over $16,000 per household as their

indebtedness increased.

This soaring inequality generated three

dynamics that set the conditions for a financial crisis. The first

resulted from limited investment potential in the real economy due to

weak consumer demand as those who consume most or all their incomes

received proportionately much less. Not being capable of spending all

their increased income and wealth, the elite sought profitable

investments increasingly in financial markets, fueling first a stock

market boom, and then after the high tech bubble burst in 2001, a real

estate boom.

As financial markets were flooded with

credit, the profits and size of the financial sector exploded, helping

keep interest rates low and encouraging the creation of new high-risk

credit instruments. This enabled more of the elite’s increased income

and wealth to be recycled as loans to workers. Financial institutions

were so flush with funds that they undertook ever more risky loans, the

most infamous being the predatory subprime mortgages that often were racially targeted.

As the elite became ever richer, those below became ever more indebted

to them. When this debt burden became unsustainable, the financial

system collapsed and was bailed out by taxpayers.

The second dynamic resulting from wage

stagnation and soaring inequality is that as the elite with ever more

income and wealth ratcheted up their consumption on luxury goods in

competition among themselves for the pinnacle of status, everyone below

was pressured to consume more both to meet family needs and to maintain

their relative status or social respectability. In effect, the elite’s

dramatically larger shares of income and wealth led to a “consumption arms race.” Pressure

was especially strong in housing, the most important asset and symbol

of social status for most Americans. As a consequence, over the three

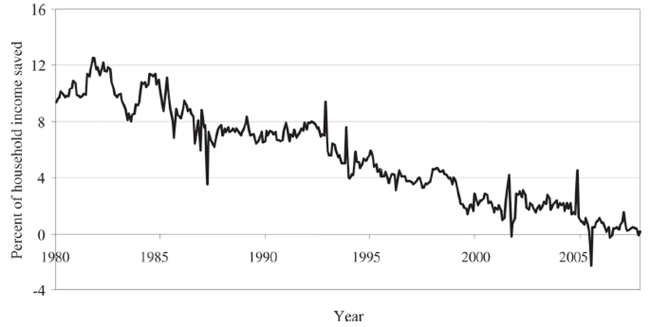

decades building up to the crisis, the household saving rate plummeted

from 10 percent of disposable income in the early 1980s to near zero by

2006, as Figure 1 illustrates. By 2007, the average married household

worked 19 percent more

hours than they did in 1979—the equivalent of over one extra work day

per week, or an extra 14 work weeks per year—and household debt as a

percent of disposable income doubled from about 62 percent in 1974 to

129 percent in late 2007.

Figure 1 – Personal savings rate 1980 – 2010

Source: Bureau of Economic Analysis National Income and Product Accounts 2012, Section 7.

The third dynamic is that as the rich

took an ever-greater share of income and wealth, they and their

corporate interests gained greater command over politics and ideology so

as to further change the rules of the game in their favor. The

proliferation of right-wing think tanks, corporate lobbyists and

corporate campaign contributions leveraged their political influence. In

their competition for status among themselves, they understandably

supported self-interested economic and political measures that brought

them yet greater shares of the nation’s income and wealth.

As the elite’s command over essentially

everything grew, so too did their ability to craft self-serving

ideology—especially supply-side economics, a variant of laissez faire

economics—in a manner that made it be ever-more convincing to a majority of the electorate.

Flowing out of this ideology were tax cuts favoring the wealthy, a

weakened safety net for the least fortunate, budget cuts for public

services, freer trade, weaken unions, deregulation of the economy

(especially the financial sector), and the failure to regulate newly

evolving credit instruments.

How did the mainstream of economists not

see the unstable financial conditions that soaring inequality was

creating? Generally because economists have not viewed the distribution

of income and wealth as an important domain of study. The 1995 recipient

of the Nobel Memorial Prize in Economic Sciences even went so far as

to declare that “Of

the tendencies that are harmful to sound economics, the most seductive,

and in my opinion the most poisonous, is to focus on questions of

distribution.” Moreover, rising inequality has long been dismissed by

economists as either irrelevant (if everyone is becoming materially

better off, the size of shares is unimportant) or as missing the

economic dynamism that inequality generates (which in fact it does not!!).

Mainstream economists were also blinded

to the dynamics greater inequality set in motion by their tendency to

focus narrowly on market phenomena, their refusal to study the manner in

which humans as social beings react to the behavior of others, and

their failure to address the nexus between economic and political power.

Economists might have stood a better

chance of foreseeing the developing financial crisis had they thrown

their nets far wider to catch the insights that have been harvested by a

wide range of so-called heterodox economists. From the

underconsumptionist tradition of Keynes, Kalecki, and Minsky they could

have developed an understanding of how inequality affects aggregate

demand, investment, and financial stability. From the institutionalist

tradition of Thorstein Veblen they could have learned how consumption

preferences are socially formed by humans who are as concerned with

social status and respectability as with material well-being. And from

the Marxist tradition they could have seen how economic power translates

into political power. Economists have failed to grasp the wisdom of one of the foremost students of crises:

“the economist who resorts to only one model is stunted. Economics is a

toolbox from which the economist should select the appropriate tool or

model for a particular problem.”

This article has been drawn from the paper “Wage Stagnation, Rising Inequality, and the Financial Crisis of 2008,” which was published in the Cambridge Journal of Economics. It was first published by USAPP@LSE.From Social Journal-Europe: Why Widening Inequality is hobbling Equal Opportunity

Why Widening Inequality Is Hobbling Equal Opportunity

Robert Reich

Under a headline “Obama Moves to the Right in a Partisan War of Words,” The New York Times’ Jackie Calmes notes Democratic operatives have been hitting back hard against the President or any other Democratic politician talking about income inequality, preferring that the Democrats talk about equality of opportunity instead.

“However salient reducing inequality may be,” writes Democratic pollster Mark Mellman, “it is demonstrably less important to voters than any other number of priorities, incudlng reducing poverty.”

The President may be listening. Wags noticed that in his State of the Union, Obama spoke ten times of increasing “opportunity” and only twice of income inequality, while in a December speech he spoke of income inequality two dozen times.

But the President and other Democrats — and even Republicans, for that matter — should focus on the facts, not the polls, and not try to dress up what’s been happening with more soothing words and phrases.

In fact, America’s savage inequality is the main reason equal opportunity is fading and poverty is growing. Since the “recovery” began, 95% of the gains have gone to the top 1 percent, and median incomes have dropped. This is a continuation of the trend we’ve seen for decades. As a result:

(1) The sinking middle class no longer has enough purchasing power to keep the economy growing and creating sufficient jobs. The share of working-age Americans still in the labor force is the lowest in more than thirty years.

(2) The shrinking middle isn’t generating enough tax revenue for adequate education, training, safety nets, and family services. And when they’re barely holding on, they can’t afford to — and don’t want to — pay more.

(3) Meanwhile, America’s rich are accumulating not just more of the country’s total income and wealth, but also the political power that accompanies money. And they’re using that power to reduce their own taxes, and get corporate welfare (subsidies, bailouts, tax cuts) for their businesses.

All this means less equality of opportunity in America.

Obama was correct in December when he called widening inequality “the defining challenge of our time.” He mustn’t back down now even if Democratic pollsters tell him to. If we’re ever to reverse this noxious trend, Americans have to hear the truth.

This blogpost was first published on Robert Reich’s Blog

1 Feb 2014

Two Graphics that illustrate the state of the economy.

These two graphics are clear demonstrations of the public debt under Key & English and where the wealth of nations concentrate when governments have no policy apart from tax cuts for the affluent and selling off the country's assets.

|

| The public debt under the money speculator- "merchant banker" |

|

| Where the wealth accumulates with tax cuts and asset sales policies. |

Subscribe to:

Comments (Atom)